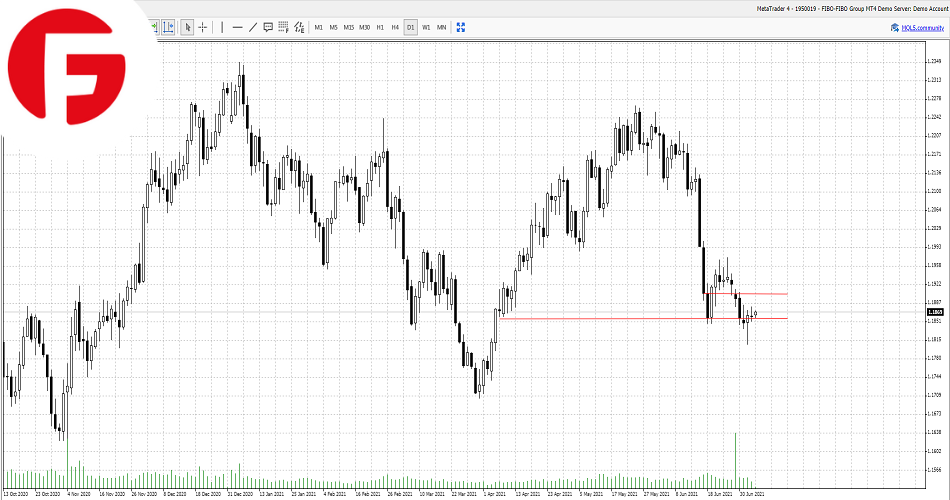

Euro/USD

The EUR/USD currency pair is stuck in a tight trading range in today’s Asian trading session, keeping with yesterday’s trend where Investors stayed away from positioning large bets on the US dollar in a quiet trading day as exchanges remained closed for the Independence Day holiday.

This should change later today as the market awaits key data from the Eurozone, Germany and the US which should create some bigger movement as the news unfolds.

To kick off during the European trading session will see the release of retail sales figures from the Eurozone followed by the Zew current situation survey which are both expected to come in better than last month. This should lend some initial support to the Euro until later in the day during the American session when the ISM manufacturing figures will be released which are expected to come in strongly, although slightly below expectations.

The news may keep the dollar well bid but the more important news for the greenback will be tomorrows release of the June minutes meeting from the US Federal Reserve where the topic of inflation and economic outlook will be on the cards.

Although some bigger moves are expected after the release of data from Europe and the US, the EUR/USD currency pair is expected to remain in the range of $1.1870 where it currently has strong support and $1.119 where it has seen strong resistance over the past week.The key to a breakout of this channel is the tone of the US Federal reserve tomorrow and how they see the current state of the American economy.